Nonprofit Payment Processing| Key Concepts for Fundraising

Payment processing makes the nonprofit world go round. Whether you’re a local organization serving fewer than a thousand constituents or a national organization with chapters in every state, your team has to be able to accept donations from a variety of places.

Donors want to be able to give to their favorite organizations through their favorite methods. Those methods could be anything: check, cash, or credit or debit card. If your nonprofit isn’t prepared to accept donations through one of those methods, you’re going to miss out on valuable resources from your supporters.

Payment processing is, simply, how funds are transferred from one bank account to another. In this case, from your donor’s to your organization’s. It’s the final step in your development strategy! But how much do you really know about how it happens?

That’s what we’re here to help with. Fundraisers and development team members should know more about what makes nonprofit payment processing so special that you can include it in your fundraising strategy going forward.

We’re going to break down payment processing and discuss how it influences your fundraising. That breakdown is going to look like this:

When you know more about the mechanics of payment processing and the importance of different features of payment processors, you can make smarter decisions to strengthen the foundation of your nonprofit’s fundraising strategy.

If you’re ready to learn more, let’s get started!

1. The basics of nonprofit payment processing.

Payment processing, from the point of the donor or consumer, looks pretty simple. Someone hands their credit card to a cashier or slides it through a pin pad, they accept the charges, and then the deed is done. Debit and credit cards have made purchasing anything from clothing to dinner easier than ever.

But when you’re the cashier or a fundraising executive, things are a little more complicated. Processing payments quickly and securely is the key to fundraising success, after all. If you can’t receive your donors’ contributions, you can’t use them to strive towards your goals!

So how does payment processing actually work?

- The donor presents their debit or credit card, or writes a check, to the organization to be charged for a certain amount of money.

- The fundraiser or other liaison from your organization sends a request for payment from your terminal/point of sale system to the payment processor. The request for payment can also be sent from an embedded processor in your organization’s donation page software.

- The payment processor sends the transaction to the card association, which then communicates the request to the bank that issued the card or check.

- The bank approves or declines the request for payment based on the contents of the cardholder’s account, their credit, or other such factors. The bank then sends the status of the request, whether approved or denied, back to the card association and then to the fundraiser.

- If the bank approves the request, then the payment is taken from the cardholder’s account and sent to your organization’s bank account, sometimes called a merchant account. This usually happens overnight in a large batch of payments.

This may seem like a complicated process, but it’s not! Thanks to the technological advances of payment processors, requests for payment can be authorized or denied in a matter of seconds, and payments that used to take days to be received by the merchant (you!) now can happen overnight.

Types of Payments

With a payment processor, your organization can accept donations from all sorts of sources. You can accept credit card donations, of course, but you’ll also be able to accept donations from debit cards, eCheck, and ACH direct debit payments.

These work through a similar process as accepting credit cards, but sometimes cost less than processing credit cards.

When choosing a payment processor for your nonprofit organization, make sure to read the fine print on pricing. We’ll talk more about what to look for in a payment processor in the third section of this article.

Essential Payment Processor Terms

Just to make sure that everyone has a solid foundation for understanding, we’re going to lay out some terms that you’ll need to understand when deciding between payment processors and learning about how they work.

- Issuing Bank: This is the organization that issues the credit or debit card to the consumer. Credit cards are issued by the bank via a card association. Major examples include BB&T and Wells Fargo.

- Card Association: The association is a group of banks that issue cards to consumers and set the transaction terms for merchants, issuers, and users. Major examples include Visa, Mastercard, and American Express.

- Merchant Accounts: A merchant account is your account! The money that your nonprofit organization deposits money into is referred to as a merchant account.

- Third-party Processor: A third-party processor is the software tool or company that your organization uses to send your requests for payment. This could be embedded in your POS system or in your fundraising page.

- Card Terminals: A card terminal is the same thing as a point of sale system. It’s the piece of hardware that your donor inserts their card into to make their donation. This hardware can be as small as a Square phone plug-in or as large as a cash register.

- Payment-enabled Software: Software that is payment-enabled is able to send your requests for payment through its own payment processor to the card association. This software could be your CRM, your donation page builder, or your CMS.

Now that we’ve nailed down the basics of payment processing, let’s move onto discussing what that means for your nonprofit and your fundraising strategy.

2. How payment processing works for your fundraising strategy.

Understanding how payment processing works is only part of the battle. Now you have to determine where payment processing fits best into your fundraising strategy.

We’ll cover everything that you need to look for in a payment processor in the next section, but we want to lay down the basics of why first. Why is payment processing so important to your fundraising strategy, and how can you leverage payment processing power to strengthen that strategy?

- In terms of cost-benefit analysis, a good payment processor will save you time and money. When you don’t pay exorbitant processing fees and your donations are in your merchant account the next morning, you never have to worry about losing half of your donations to a processor or not being able to pay bills on time because of delayed transactions.

- A secure payment processor will instill trust towards your nonprofit in your donors. They’ll feel better donating when they know that their information isn’t at risk, and they’ll have faith in your ability to steward their funds appropriately based on your other responsible decisions.

- A payment processor isn’t only valuable for collecting donations. With a strong software solution, you can also process membership fees, merchandise purchases, and registration fees and tickets to events. All of these activities support your nonprofit’s mission, and it’s crucial that your payment processor handle them quickly and easily.

- Choosing the right payment processor for your nonprofit can also help your financial department quickly settle and reconcile transactions, which saves your team time as well as improves the connection between your fundraising staff and your financial staff.

A strong payment processing software solution is a crucial aspect of both your technology strategy and your fundraising strategy. It can help with data collection, organization, and more—but only if you know what you’re doing and what to look for.

Let’s go over a couple of common questions and misconceptions about payment processors to get you on the right track.

How will my payment processor work with my CRM?

This question is especially important for large nonprofits that have too many donors, members, or event attendees to key in by hand. The answer lies in understanding which payment processors do integrate with your CRM, and which don’t.

We’ll go over the importance of software integrations in the next section, but the first thing that you have to know is that not all payment processors will integrate with your CRM. Some, like most card terminals, will only accept payments. They don’t keep any data beyond what they need to make requests for payments.

Some payment processors do integrate with other software options, though, so make sure that you do your research before making a purchase. A strong integration is crucial to a well-managed donor data strategy.

Is a payment processor the same as an online donation page?

This is a common misconception, but no, they are not the same. A payment processor, rather, must be integrated with your online donation page. Payment processors should offer programming tools that allow a gift to be entered into a donation page and then securely transmitted to the card association via the processor.

Many payment processors offer their own page to donors in order to capture the payment directly. This option, while functional, may be discouraging or off-putting to donors and nonprofits alike for several reasons:

- It requires leaving the nonprofit’s website in order to complete the donation, which makes a donor feel as though they’re not giving to the nonprofit directly and might make them abandon the donation process.

- When the external donation page doesn’t match the branding and imagery of the nonprofit organization, it makes donors wary of inputting their sensitive payment information.

- The third-party website may not push donor information back to the nonprofit, which severely inhibits the ability of the nonprofit to follow donor activity, collect contact information, and accurately track donor retention analytics.

The payment processor doesn’t have anything to do with the front end or user-facing aspect of the donation page. Instead, it handles the behind-the-scenes transactions.

Now that you know some of the pitfalls of choosing a payment processor, let’s get into the nitty-gritty of choosing the right one for your nonprofit organization.

3. What to look for in a nonprofit payment processor.

Choosing a nonprofit payment processor is an important part in your fundraising strategy. There are a lot of different things to keep in mind. They’ll vary by nonprofit: depending on your size, constituent base, major giving strategy, and more, you’ll have different needs than any other nonprofit.

Consider your own organization. Which is a higher priority, a lower upfront cost or lower processing fees? How easily will this processor integrate with your donor management software platform?

As you ask yourself these questions, don’t be afraid to include the following variables as well.

Nonprofit experience and expertise.

While the more massive payment processors are a valid choice for smaller nonprofits that can’t pay for a specialized platform, they’re not always the best choice. Nonprofits have to obey laws that for-profit business don’t, just through their nature.

When looking for a payment processor, try to find one that is built for nonprofits or has worked with nonprofits in the past. You’ll find that a nonprofit-minded processor will help your fundraising strategy far more than a generic one will.

Top-notch security features.

One of the most, if not the most, important features in your payment processor is its security. When you’re considering a nonprofit payment processor, you have to make sure that you’re choosing one that takes donor data security seriously.

If your donors’ data becomes compromised or stolen after a transaction, you run the risk of losing them and anyone else who hears about it as a supporter. That would be catastrophic.

However, you can mitigate this risk by choosing a payment processor that has the following security features:

- PCI compliance, or compliance with the Payment Card Industry Security Standards.

- Address verification systems.

- BIN blocking, or bank identification number blocking.

- CVV requirements, or card verification value requirements.

- Card number and name tumbling, which encrypts that data

While PCI compliance is the number one thing to look for, the other security standards listed above are also important to have in your security lineup. Don’t skimp on these measures—they’re crucial to your position as a trustworthy steward of donations.

Ongoing support.

When looking for payment processors for your nonprofit, consider the level of ongoing customer support that they offer. No matter how well the processor works, at some point you’re going to have to call customer service and ask for help.

This process is made much easier by choosing a processor from a provider that offers free, extensive support all year round. If you need system customization or to refund a donor’s contribution, you’re not going to want to wait 6-10 business days for it.

Seamless operations within your donor database.

On the same note, you’ll want to find a payment processor that can easily integrate with your other software options. This is especially important for your donor database. When payment information flows from your payment processor into your donor database, you’ll be better equipped with a 360-degree view of a donor’s engagement.

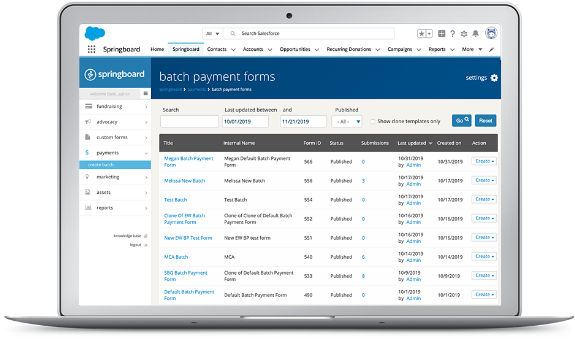

When possible, take advantage of the payment processor that comes with certain donor databases. Not all offer this option, but those that do combine all of our previous must-haves with another top consideration: an in-system payment processor.

Using your donor database’s proprietary payment processing system gives you the ability to create far tighter integrations than using a third-party payment processor, streamlines the product and customer support process, and reduces the time and effort necessary for tasks like financial reconciliation.

Why ClearView CRM?

Choosing a payment processor can be a long and difficult process. But what if your CRM came with a payment processor that checked all of the above boxes, without any further hassle?

That’s where ClearView CRM comes in. Our CRM, in addition to online fundraising, event planning and management, and donor data management capabilities, includes a top-of-the-line payment processor.

When you use ClearView CRM’s donor database software in conjunction with the proprietary SofTrek Merchant Services payment processor, your nonprofit can use the data you have, not available through traditional third-party processors, to settle and reconcile transactions automatically.

This can decrease the time required for monthly reporting and accounting tasks drastically, freeing up your staff to do other things!

To learn more about how using ClearView CRM can save your administrative team a lot of time and headaches, head over to our fundraising software donor services page and take a look.

Payment processing is the backbone of your fundraising strategy, so make sure you and your nonprofit are well prepared! When you choose the right processor, your whole arsenal of fundraising tactics will improve. For more awesome fundraising resources, check out a few of our favorites below:

- Nonprofit Fundraising Statistics for 2019. Learn more about the current state of fundraising with this easy-to-understand breakdown from Double the Donation.

- The Ultimate Donor Segmentation Cheat Sheet. Donor segmentation is a valuable strategy for improving marketing, fundraising, and so much more. Check out our easy guide and score a free download in the meantime.

- The Donor Analytics Crash Course. So you have all these donors, but you don’t know how to get to know them. Don’t fret! Identify the most important donor metrics for building relationships with this guide from DNL OmniMedia.